by Jenny Fan and Melissa Wrapp, University of California, Irvine

“For the UCI research team, these sessions offered rich insight into the practices, experiences, and beliefs of everyday Orange County residents who are grappling with financial challenges and the ongoing effects of the pandemic economy.” —The Authors

Authors’ notes: Photovoice is a community-based participatory research approach in which participants tell stories about their lived experience through photography. UCI’s Community Credit research project is using photovoice as one method to explore people’s financial lives and identify ways for financial institutions to better understand their community’s actual needs. The UCI photovoice research team included Dr. Bill Maurer, Community Credit’s Principal Investigator, Professor of Anthropology, and Director of the Institute for Money, Technology & Financial Inclusion (IMTFI); Dr. Melissa Wrapp, anthropologist and Community Credit’s postdoctoral project manager; and Jenny Fan, IMTFI manager.

In Spring 2022, Community Credit piloted the use of photovoice as a method for understanding people’s financial stories. This pilot included public listening sessions and discussions of the methodology, which were attended by local nonprofits, credit unions, and community members. Among the attendees was Abrazar (“to embrace” in Spanish), a nonprofit serving residents in Orange County, California. Abrazar offers a range of services, including a 12–18-month financial empowerment program for low-income residents known as SparkPoint OC. After participating in Community Credit’s public listening sessions, Abrazar was interested in exploring the use of photovoice within this program, both as a beneficial experience for clients and as a program evaluation tool. So, following on their first pilot, in Fall 2022 the UCI team partnered with Abrazar to run an online photovoice training for SparkPoint clients and coaches: “Embrace, Educate, Empower: An Abrazar-UCI Photovoice Project on Financial Security with PhotovoiceWorldwide.”

This second photovoice project included 17 participants made up of Abrazar clients, financial coaches, and nonprofit leadership. Participants met for four 2-hour sessions, simultaneously interpreted in Spanish and English, in which they learned about the ethics and practical elements of using photography as a research tool. Over a period of several weeks, participants took photos to explore the concept of financial security: what it looks like, how it’s created, and how does one feel when thinking about money. The questions used to guide participant-researchers also focused on understanding their hopes for the financial future and lessons they have learned from participating in the SparkPoint OC program.

The Photovoice Process: Telling Stories

Before each session, participants used an asynchronous multimedia platform, VoiceThread, to upload, share, and discuss their photos. The group uploaded more than 60 photographs for each session (about four photos per participant), resulting in a total of 200 photos captured. During each session, participants reflected as a group on their experience as researchers, and then broke out into smaller discussion groups. Through talking about their photos, people shared their financial stories, both of struggle and resilience, probing topics including debt, housing insecurity, family, and mental health.

While at times challenging, participants repeatedly expressed gratitude for being heard and included in this learning community. This fostered a sense of solidarity amongst participants, and a realization, as one participant shared, that “I’m not just going through this alone, but many other people are also going through these types of situations.”

As participants discussed the photos and developed a sense of commonalities in their experiences, they began to experiment with sorting the photos into different categories. Some categories were more literal and focused on similar subjects in the images; others were more symbolic, homing in on resonances in meaning and interpretation.

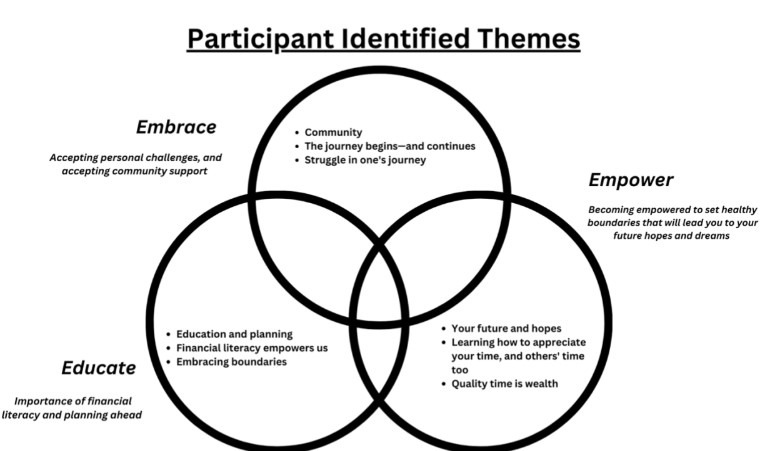

Through analyzing their own photographs, the group collectively identified nine themes, which are shown in three intersecting circles below:

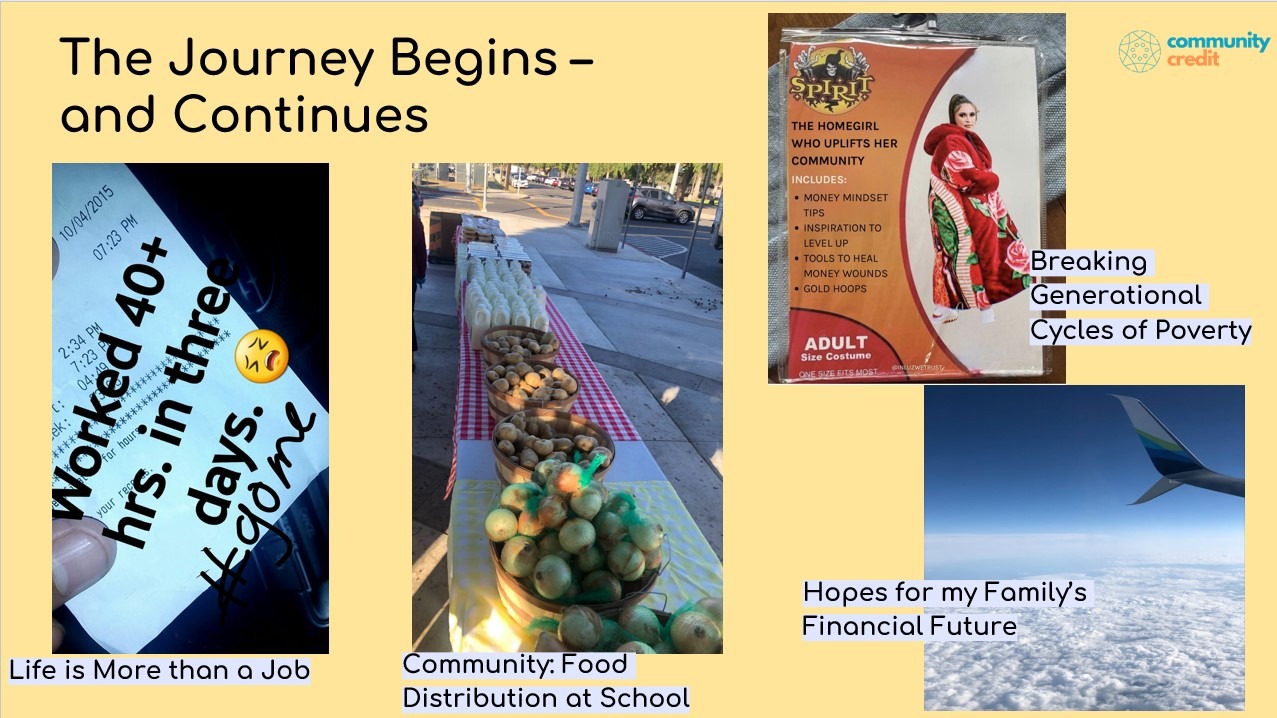

Each participant, and each photo, connected to these themes in unique and powerful ways. Below is a selection of participant photos taken to address the prompt “What is a lesson about money you hope to pass on to your family or community?” The group discussed these themes in relation to Abrazar’s tagline— Embrace, Educate, Empower—which also became the exhibit’s organizing framework for a forthcoming exhibit (details below).

Participant Photos

“Fair—One doesn’t need to spend money to have fun, it’s important to save.”

It’s a normal day, spending time with my family. It’s not the place. It’s not the moment. We gave ourselves some time with our children to play with them. It was in front of a Home Depot store where we found this cart and my daughter wanted to get on it. And so we started to turn around with the cart and they had so much fun. Sometimes it’s not necessary to take them to a theme park or to a place where it costs a lot of money. It’s something so insignificant, but it gave us so much joy. We had so much fun—we laughed and we didn’t spend any money. I think many times we want to go to a fair or something like that where kids can go on rides. But right now they got on this cart and they had fun and we didn’t spend any money. I think that trying to transmit to my children—learning to say no, when you can’t buy something. Many times we have money, and we all say yes, and we don’t learn to manage our money well. This is something that I want to transmit to my children, that we should save money to go somewhere nice, but also we have to save so that we can have fun in a different space. That doesn’t have to be a specific fair or theme park.

This photo, like many of the others, transformed in meaning as the participant spoke in the session. It illustrates more than just a family trip to the hardware store, instead offering a contemplation on where and when joy can be found with family, and the importance of setting boundaries with spending.

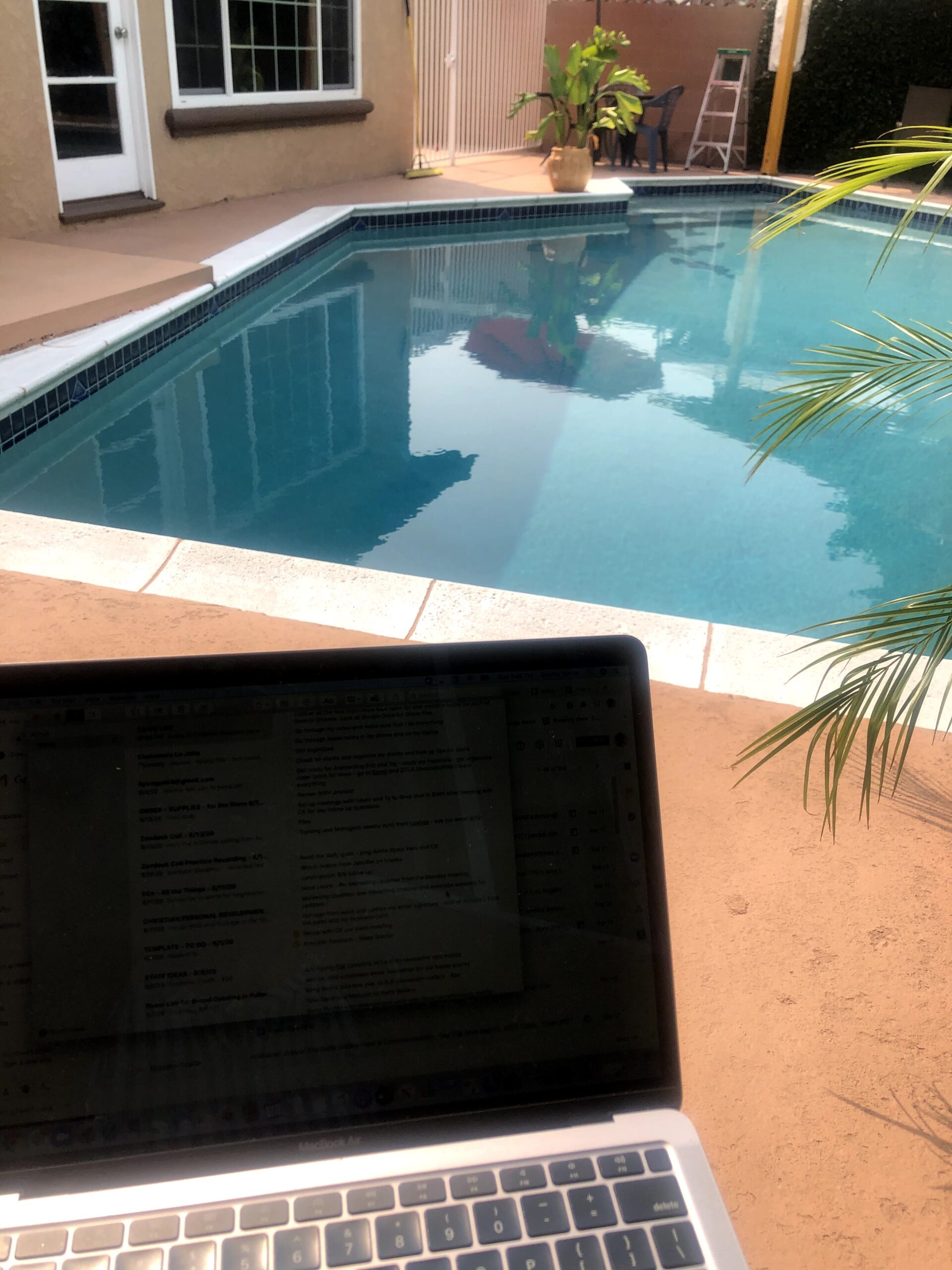

“Entrepreneur, WFH, Investing, Financial independence”

This photo demonstrates both a lesson and hope that I have for my family and children. I hope that they educate themselves, become financially literate, and use their skills and abilities to start their own businesses, become entrepreneurs, work from home, save their money, invest in real estate, stocks, and assets, and obtain financial independence. In this manner, they will not have to struggle financially, deal with toxic and traumatic work environments and relationships, and can enjoy their lives and the fruits of their labors with reduced worries.

To the photographer, “WFH” (or working from home) didn’t just literally represent her everyday experience, but was symbolic of, and connected to, a more complex series of aspirations around autonomy, control over one’s life, and her desires for her family’s future. It was placed under the theme of education because, as the participant put it, “in order to achieve the other things I mentioned in the caption, in order to have financial freedom and independence, it starts with education.”

“Dreamer: Education is Something Nobody Can Take Away”

This image represents my journey of attending college and pursuing a career. When I started college, I was undocumented and felt that attending college was pointless because I wouldn’t be able to pursue a career in my field. I was afraid of the unknown, but I decided to put my fears and doubts aside and continue my education. On June 15, 2012, Deferred Action for Childhood Arrivals, DACA passed, protected undocumented youth who came to the U.S. as children from deportation and provided a work permit. I finished my college education “DACAmented,” and it changed my life. The words you see, “UNDOCUMENTED, EDUCATED & UNAFRAID,” are my experience. I want my son and community to know that we have to look beyond our fears even though the future seems unclear. If we live in fear, we will never succeed.

“…we have to look beyond our fears even though the future seems unclear.

If we live in fear, we will never succeed.”

Many photos overlapped with several of the participants’ themes. In this moment, the financial coach was vulnerable about her own journey, which not only created space for others to be vulnerable, but also provided a model for some about what it may be possible for them to achieve, too.

Next Steps

Although the photovoice sessions themselves are complete, Abrazar and UCI are continuing to collaborate on next steps. For the UCI research team, these sessions offered rich insight into the practices, experiences, and beliefs of everyday Orange County residents who are grappling with financial challenges and the ongoing effects of the pandemic economy. The research team is working to analyze this data. For Abrazar, the sessions form the basis of a toolkit that they are developing in collaboration with Community Credit and PhotovoiceWorldwide. This toolkit will offer support to financial coaches in enhancing client relations, helping clients set goals, and tracking progress.

“We embrace lived experiences and listen to the community’s voice to evaluate our program.”

—Mario Ortega, Abrazar CEO.

Photovoice is an inherently participatory act, a way of collective meaning making. “One of the unique aspects of this process is that we are co-creating and co-designing this project with the community,” says Mario Ortega, Abrazar CEO. “We embrace lived experiences and listen to the community’s voice to evaluate our program. We are not taking the community voice as a transactional, ‘check the box’ form of community feedback that is still too often present in programs for the community.” Looking back on their experience, participants shared that the photovoice process made them look at things from a different perspective. They will share that newfound perspective in an upcoming online virtual reality exhibition designed through Artsteps and in-person photovoice exhibit on May 12 as part of the “May Your Mental Health Thrive with H.O.P.E. (Health Opportunity Progress Equity)” Health Fair at the Delhi Center in Santa Ana.

Endnote: This material is based upon work supported by the National Science Foundation (NSF) under Grant No. 2137567. Any opinions, findings, and conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of the National Science Foundation.